| Exercise 8.10 |

|

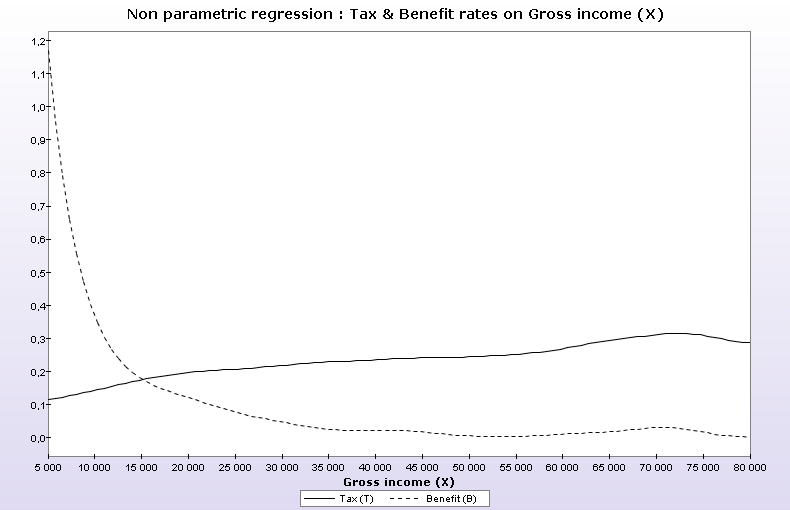

Compute the average tax rate paid by individuals at different levels of gross income X and at different ranks of X. Estimate this as the expected tax paid at X over X. What does this say about tax progressivity in Canada? |

|

Answer |

|

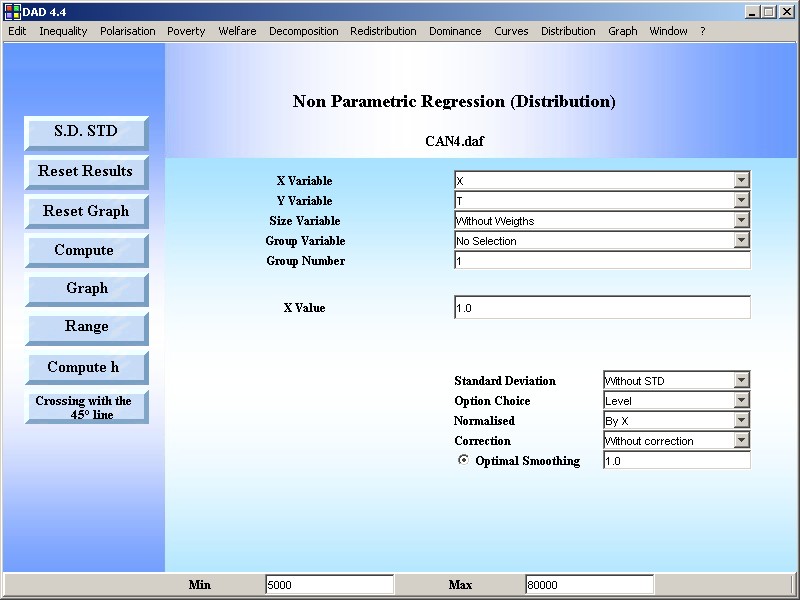

STEP 1: Use the DAD Application: DISTRIBUTION|NON PARAMETRIC REGRESSION |

|

RESULTS |

|

|