| Exercise 8.2 |

|

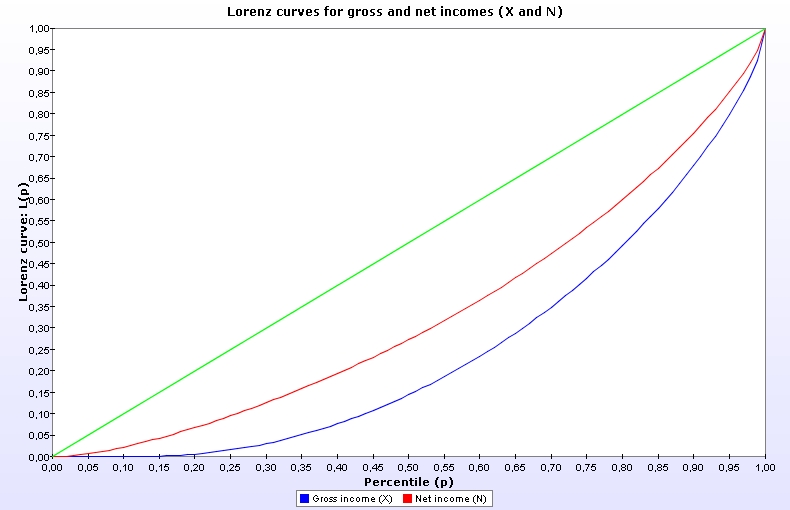

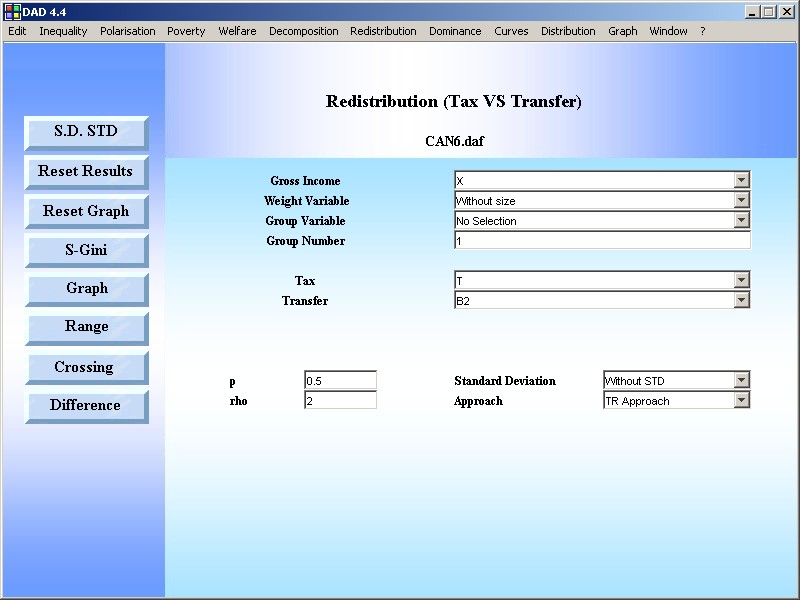

Use the file CAN6 to draw the Lorenz Curve for gross income (X) and net income (N) in 1990 Canada.

|

|

Answer (a) |

|

STEP 1: Use the DAD Application: CURVES|LORENZ CURVE |

|

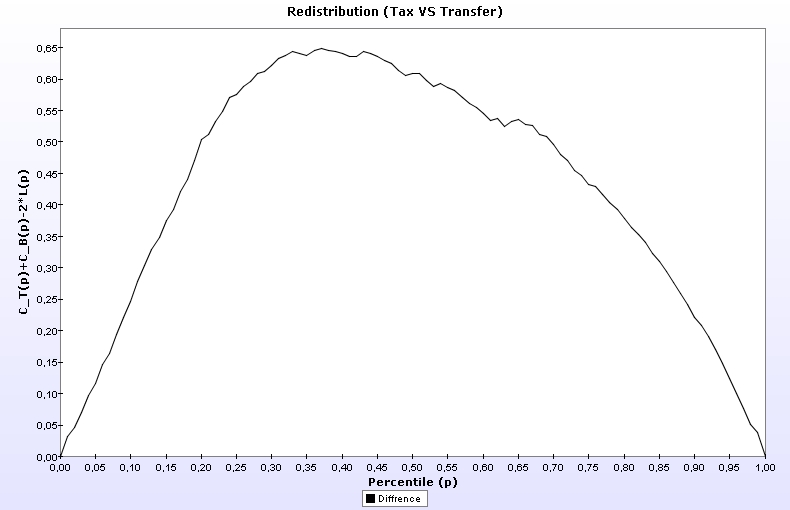

RESULTS |

|